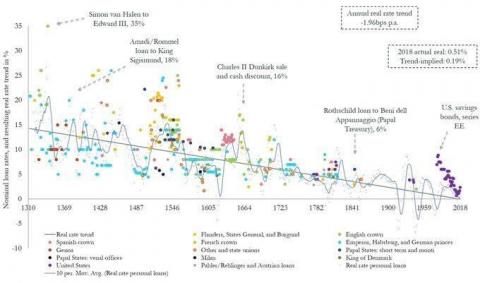

Interest rates are low .... but they will go back up, right? Well what if that thinking is wrong? Let's start with interest rates and the 700 year chart above. There is a clearly downward trend over 700 years. Each century seeming to drop on average by about 5% until we have finally reached zero in 2020. So here's an idea:

- Capital markets are now so efficient that money has been priced to perfection.

- Many people around the world have spare money at any moment, so that money should be cheap provided it can be efficiently allocated.

- Even someone with no money has $10 in their wallet for most of the day until they spend it on dinner, that money could be put to use during the day in a hyper efficient market.

That's why money is nearly free, because of market efficiency. Excess money anywhere in the world can now be used almost immediately anywhere else in the world.

The proof of this is credit cards A regular person can directly create money that did not previously exist through using a credit card. This is a very recent innovation and arguably has vastly increased the efficiency of global capital markets, since the provider of the card can finance the funds from anywhere else in the world.

Prove it to yourself. Buy something on a credit card. Pay off the card at the end of the month, no interest to pay. Not only is it free, it is highly likely that some part of your borrowing was financed from overseas through a global liquidity pool.

Is it technology that has made money cheap and not quantitative easing? Also, why should the 700 year falling trend stop at zero?