Imagine being on a boat in the ocean on a very still day. No wind. No swell. The water is flat as a mirror. The calm goes on just long enough for you to start to feel like it’s normal.

When a small wave finally does come, it feels big. When a normal-sized wave comes, it feels enormous. And when a big wave comes…?

As scary as they might feel, waves are normal. Even storms are normal. The question is, what do we do when a storm does come?

In terms of investing, people often freak out and abandon ship.

You know how that goes: We sell when the market is low because it’s crashing and that’s scary, then we buy when the market is high because it’s rising and that’s exciting.

Obviously, this is a very bad idea. The last thing you want to do as an investor is buy high and sell low.

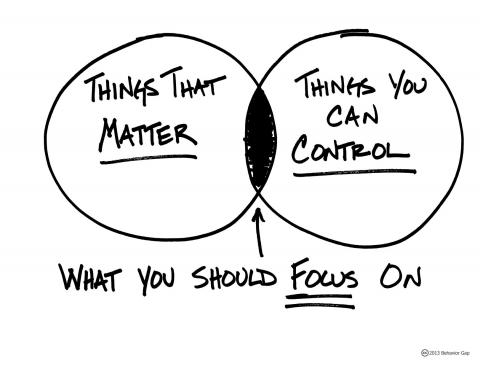

Of course, this doesn’t just apply to our investment behavior.

For example, I bet you can think of a friend or family member that blows out of every relationship at the first sign of trouble. Seas are calm, smooth sailing… uh oh... is that a storm cloud on the horizon? I’m outta here!

And yet, as anyone who has been in a relationship for more than a few months knows… storms happen. Volatility is normal. Ups and downs are part of the game.

That may not sound very romantic, but it’s certainly realistic. And in this case, realism may help prevent you from making what I like to call The Big Mistake: abandoning ship in the middle of a storm.

Hope that helps.

Carl Richards (www.behaviourgap.com)