Julie's Blog Posts

One of the qualities I most admire in my own Clients, is their ability to maintain an open mind. It's a common trait with successful people. The ability to give every idea and concept a listen - evaluate the information carefully - before arriving at a conclusion that best suits them.

With all the negativity in the media - particularly in the area of finance at the moment - it can be hard for people to maintain that open mind when talking about superannuation, investments or even Financial Advisers!

Our office gets phone calls all the time from members of the public looking for help with their finances. After all, is there a more important area of your life (outside of health and family) than trying to preserve and grow your capital base (be it your superannuation, rental property, cash reserves etc)?

My best tip for folk that are wanting advice. Speak to 2 or 3 Advisers and go into each appointment with an open mind. Let each Adviser share their story, their house view on how to run client's investments and then go away and compare and contrast all that you have heard. If you walk in with a mind already closed to new ideas, you will gain nothing new.

Till next time.... Julie

Let me tell you a little story.

It’s the story of a consultant who had a scary idea. She wanted to publish a cookbook. She had no background in writing, publishing, cooking, blogging or anything related to that goal.

In this tall tale, the consultant left her job to follow her dreams, as the cliché goes. And the next thing you know, the story unfolds just as you would have hoped. The universe conspires — magically! — to give her a helping hand. She finds an agent and snags a contract with a top publisher. She even gets the television personality Anthony Bourdain, a famous chef, to do the blurb on the book cover.

Cool story, right? But we all know stories like this one don’t really happen. You need a degree from the literary starmakers at the University of Iowa Writers’ Workshop, a successful stint on “Iron Chef” or at least 10,000 Instagram followers before you can even dream of doing something like that.

But wait! This story is actually true. The woman who made it happen is Reem Kassis, and her cookbook is “The Palestinian Table.”

So why share the story? Not because it is so crazy but because it is so sane. The way Ms. Kassis pursued her scary thing is practical and repeatable. She did things that anyone can do, as long as you have the nerve to try to do something hard and scary in the first place.

Ms. Kassis grew up in Jerusalem but came to the United States to pursue an undergraduate degree at the University of Pennsylvania. She eventually worked as a consultant for McKinsey & Company before leaving to have her first child.

It was around then that she decided to give this far-fetched cookbook idea a shot. She was not dabbling in writing at the time. She didn’t have a side hustle making food at a restaurant. She didn’t have a blog or an Instagram account. All she had was a stake in the ground and a direction she wanted to go.

Oh, and she had those roadblocks. Enough roadblocks that most people would have labeled such an idea unrealistic and given up.

But one pattern I’ve noticed in people who do scary things is that once they see the roadblocks in their way, they take a specific kind of action to begin to break them down — a micro-action. Having figured out the big goal, they focus on the next, smallest action that will get them a bit closer to it.

Because Ms. Kassis wanted to publish this book in a traditional way, the most obvious roadblock was her lack of a publisher. To get one to take you seriously, you generally need an agent. To get an agent, you need to send what’s known as a query letter. (See how we’re moving from big, insurmountable roadblocks to smaller actions?)

But first, you need to figure out which agents to approach. So here’s what Ms. Kassis did first: She went to the bookstore, picked up a cookbook and read the acknowledgments section. She noticed that the author thanked an agent in the acknowledgments, and she wrote down the name of the agent.

There is more to this story, but please note how micro this action was: a trip to the bookstore. Having noted the name of one agent in one cookbook, the next smallest step was to pick up another one. She repeated these steps with every cookbook she could find until she had a list of agents.

The next smallest step was to go home and research those agents, one at a time. That allowed her to write each of them very targeted emails. Because she was so thorough in her research, she got an almost unheard-of response rate. Eventually, she landed an agent, and now there’s a published cookbook with her name on it.

Once you’ve identified the scary thing you want to do, don’t obsess over all the reasons you can’t do it. Get quiet and ask yourself one simple question: What is to be done next? Then look for the next smallest action you can take. Do that thing. Ask again. Repeat.

I can’t guarantee that if you follow the Next Smallest Action Formula that you will succeed. But I can guarantee that if you don’t take any steps at all, nothing much will come of your idea.

This column, titled A Story of a Big Dream and a Single, Small Step, originally appeared in The New York Times on November 21, 2017 - by Carl Richards www.behaviourgap.com

We’ve been told over and over by the traditional financial services industry to look for the best investment. In our search for the best, we often use past performance. Doing so makes sense since we rely on past performance for other decisions.

For instance, if a university needs a new basketball coach they start by reviewing a coach’s track record. Do they win more than they loses?

However, in a crazy paradox, selecting an investment manager using past performance may not be the best choice. But how is this possible? Hiring someone who performed terribly makes little sense.

Even using a disciplined process and the best data we can find, "smart" activity often creates a behavior gap. The reality is that even if you own a mediocre investment, but if you behave correctly (sometimes that means doing nothing), you’ll outperform 99% of your neighbors.

In the end, successful investing is more like planting an oak tree than hiring a basketball coach.

You never plant a tree and then pull it out every time the wind blows just to check the roots. This simple, but not easy, approach reminds me of Warren Buffett who said:

"Benign neglect, bordering on sloth, remains the hallmark of our investment process."

Based on many conversations I’ve had, this attitude feels wrong. It seems like a contradiction to the Protestant work ethic. If something isn’t painful or hard, it’s not worth doing.

But when it comes to investing, we’re dealing with a different animal.

Once we’ve made a decision based on our personal goals and plans, often the best thing we can do is practice benign neglect. Simply do nothing, even though it feels wrong.

Try it. I think you’ll find that trees grow much better when you stop looking at the roots all the time.

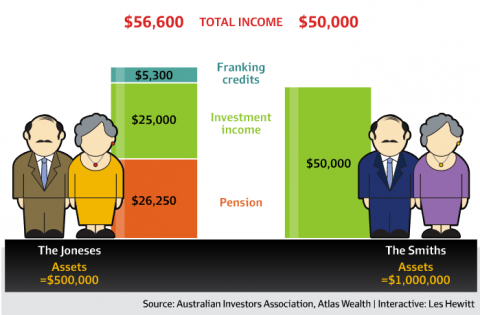

Labor have announced that if they get into Office, they are going to remove the imputation credit system for self funded Retirees.

So what does this mean? If you buy Australian shares, most large companies pay the company tax out of the dividend before they distribute to the shareholders. So by the end of the year most shareholders have the income in their bank acount that was paid by the company AND an 'imputation credit' certificate that shows how much tax was paid, by the company, on their behalf. At tax time, the shareholder can ask the ATO for the imputation credits back as a refund .... if they don't need them to offset tax they would otherwise have to pay. This is very attractive for Retirees who either hold shares in superannuation in a tax free pension (so they are guaranteed to get all the tax credits returned to them) OR fall under the tax free threshold outside of super... so also get their imputation credits refunded to them.

The Labor Party intend to stop imputation credits flowing to Retirees - unless they qualify for an Age Pension.

One of the unintended consequences of Labor doing this, is that it will prompt some self funded Retirees to spend their funds to get back onto the age pension. Self-funded retirees are already up in arms about Turnbull's attack on superannuation, and the unfairness of an age pension system which punishes thrift and rewards those who have saved nothing towards their retirement. The general feeling among self-funded retirees now is "what's the point?".

The cost of welfare in this county is growing at 8% per a year. All parties should be focused on encouraging retirees to become self sufficient and get off welfare. In my opinion, Labor's policies would do the opposite.

I have attached an article that oulines some of this impact from the Australian Financial Review. If you want to talk further about this matter, please don't hesitate to pick up the phone or send me an email. Remember, it is not in force yet, there is no election being called just yet - but I think its important we all start bringing awareness of this issue out into the open now, so ALL Politicians learn the full impact of their decisions. All for now, Julie