Here you will find interesting quotes, useful information and links to helpful articles on a wide variety of subjects.

Julie's Blog Posts

Quote of the Week!

Happy New Year!

Season's Greetings

Merry Christmas and Happy New Year from all of us at ES&A.

Please note our office will be closed from Monday 22 December. We will reopen with limited staff from Monday 5 January, with our full team returning on Monday 12 January.

Wishing you rest, celebration, and a wonderful start to 2026!

Welcome to 'Goonagullah House'

We’ve Moved Offices! After more than 20 years in our previous location, we’re pleased to share that we’ve moved to a new space: 90 Lindsay Road, Buderim - ‘Goonagullah House’, a heritage-rich Queenslander.

This new chapter allows us to continue our work in a setting that reflects our values of care, connection, and community. We look forward to welcoming you here.

Invest Like a Retiree - final seminar for 2025!

Join us for our final seminar of 2025 — a story-rich evening filled with practical strategies for making your retirement savings last. We’ll skip the jargon and the stuff you can Google, and focus on the real advice that helps retirees live well, year after year.

See our Upcoming Event tab for all the details.

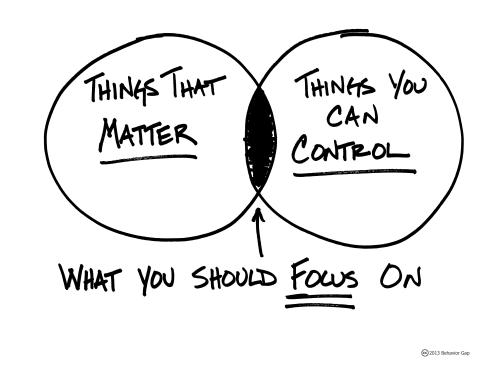

Don't over think it!

Most financial “problems” aren’t problems at all.

They’re just thoughts about things that might never happen.

Worry disguised as productivity.

Let it go.

Hang Tight!

Imagine it’s a very still day, and you’re in a boat on the ocean.

There’s no wind.

No swell.

The water is as flat as a mirror.

The calm goes on just long enough for you to start to feel like it’s normal.

When a small wave finally comes… it feels big. When a regular wave comes… it feels huge.

As scary as it might feel, it’s important to remember that waves are normal.

In fact, occasional storms are normal.

And the last thing you want to do when you get into a storm is abandon ship.

Attached is a short read on the US Tariffs and the market reaction - definately worth a quick look.

- Julie

(with credit to Behaviour Gap)

We are now accredited Aged Care Specialists!